OUR SOLUTIONS

Additional Views

CreditForecast.com makes new cuts of Equifax data available under six additional views as described below. These views are available through a separate subscription and are available as downloads or custom deliveries by product category. These additional views allow for more detailed segmentation by borrower demographics such as income, age, and presence of a mortgage, and they provide further insight into consumer credit behavior and performance. The additional views are available as historical data off the shelf. Please contact us if you are interested in forecasts based on these new data views.

| Metro Score Cuts | Regional Borrower Trends | Regional Vintage Cuts | National Score Migrations | National Borrower Trends | State Borrower Trends | |

|---|---|---|---|---|---|---|

| Segments | View 1 | View 2 | View 3 | View 4 | View 5 | View 6 |

| Geography | MSA | MSA + STATE | MSA + STATE | U.S. | U.S. | STATE |

| Vintage | ||||||

| Origination Credit Score | ||||||

| Current Credit Score | ||||||

| Term | ||||||

| Personal Income | ||||||

| Borrower Age | ||||||

| Presence of a Mortgage |

All credit metrics available in the Base Package are also available for these views. Similar to Base Package views, these additional views provide data, updated monthly, back to 2005.

Key Features

Data

- Credit data for 24 product categories and subcategories, by origination and current risk score bands, as well as term bands for installment loans

- Credit score migration

- Detailed level of geography (metropolitan areas, rest of states, states, U.S.)

- Quarterly origination vintages

- Historical risk scores based on VantageScore

- Personal income of borrowers

- Age of borrowers

- Presence of a mortgage

Updates

- Monthly data updates

Categories

To ensure detailed coverage of all major types of consumer credit, CreditForecast.com provides credit data for seven mutually exclusive product categories and 14 subcategories. Users can license all seven product categories for the full picture of U.S. consumer credit, or they can license just the categories that are most important to their business.

- Auto

- Bankcard

- Consumer Finance

- Retail

- First Mortgage

- Home Equity

- Student Loan

Please go to Product Coverage for a full list of product subcategories.

Historical Data

The historical credit data are made available from 100% of the Equifax National Consumer Database. As information is being added to the database, it goes through a rigorous quality-assurance process, including automated and manual reviews, to ensure the highest accuracy possible. The credit data are sourced from the full Equifax credit database and include consumers with at least one active trade. This results in approximately 220+ million consumer records in a given month. Selection always occurs at month’s end so that the results are not affected by in‐month reporting fluctuations. Monthly historical files starting with June 2005 were used. Therefore, full “open‐to‐close” vintage data are available starting with July 2005, while information on trades in older vintages—when available from the consumer credit files—is also included. Equifax developed special credit trend attributes that aggregate the consumer files into attributes specifically intended for monthly trending. These attributes consider only trades with activity in the last three months and look only at current delinquency statuses in order to focus on the true state of credit (balances, high credits, delinquencies, etc.) in the given month. These attributes were calculated for each consumer file and then aggregated to the ZIP code, county, metropolitan statistical area, and state levels. This will allow CreditForecast.com to quickly adapt to any future changes in county or MSA definitions.

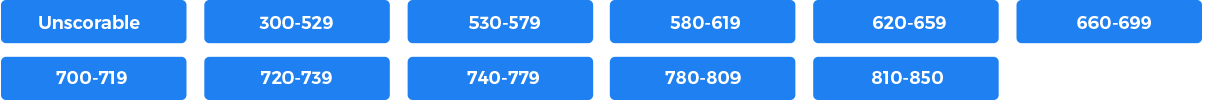

Score Bands

Origination and current risk score-level classification is done at the consumer level, based on VantageScore 3.0 – Odds Scale (score range 300‐850). There are 11 score bands, allowing the user flexibility in identifying consumer risk profiles of interest.

Term Bands

Installment loans (auto, consumer finance, first mortgage, HELOANs, and student) are further classified into loan term bands. Loan term is reported by lenders and financial institutions and represents the number of months an installment loan is to be paid. CreditForecast.com provides loan term on installment loans in fixed ranges or bands at the time of originations.

| Product Category | Description |

|---|---|

| Auto Lease |

<=24 months 25-39 months 40+ months |

| Auto Loan |

<=24 months 25-39 months 40-63 months 64-75 months 76+ months |

| Student Loan |

< 120 months 120+ months |

| Product Category | Description |

|---|---|

| First Mortgage |

< 180 months 180-359 months 360+ months |

| Home Equity Loan |

< 120 months 120-179 months 180-359 months 360+ months |

| Consumer Finance Installment |

<= 6 months 7-12 months 13-24 months 25-59 months 60+ months |

Geographic Segmentation

- U.S.

- 53 states/territories

- 457 MSA/rest‐of‐state areas (complete coverage of the entire country)

Vintages

CreditForecast.com provides quarterly vintages starting from 2005 until current. The annual vintages start in 1996 and go through 2004, with older vintages aggregated into the 1990 and 1995 cohorts which represent pre-1990 and 1990 to 1995, respectively.

Consumer Credit Data Series

For each of the categories, data are available for the following variables:

PERFORMANCE METRICS

- Total outstanding number of trades

- Total outstanding balance in dollars

- Current number of trades

- Current balance in dollars

- Total delinquent, 30 DPD, 60 DPD, 90 DPD, 120+ DPD or collections number of trades

- Total delinquent, 30 DPD, 60 DPD, 90 DPD, 120+ DPD or collections balance in dollars

- Number of trades that are in default, bankruptcy or closed positive

- Balance in dollars of loans that are in default, bankruptcy or closed positive

- Foreclosures started for residential products

ADDITIONAL METRICS

- Number of trades with positive balances

- Scheduled payment amount in dollars

- High credit (credit limit) in dollars

- Utilization rates

CreditForecast.com also provides delinquencies and terminal states (default, bankruptcy, closed positive) as rates as a percentage of outstanding trades or as a percentage of outstanding dollars.

CreditForecast.com provides origination estimates such as number of trades, maximum high credit (credit limit) in dollars, and maximum balance drawn in dollars.

Personal Income of Borrowers

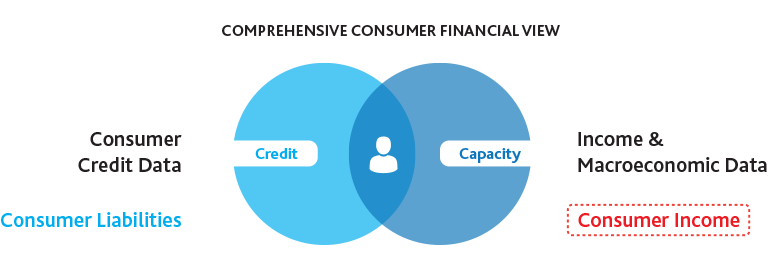

Personal income of borrowers are continuous estimates of individual-level income corresponding to an estimated annual income in thousands. The estimates are based on Equifax’s unique employer-provided employment and income data, thereby avoiding less reliable data sources, such as census or self-reported income.

CreditForecast.com offers a comprehensive consumer view for better risk transparency and marketing optimization.

Personal income model ranges were created based on population distributions pulled from 100% of Equifax consumer credit files. Equifax compared multiple points in time to determine if any distributions shifted over time. Some minor adjustments were made to the ranges to ensure enough trades/accounts would fall in each range to reduce the risk of low cell counts.

| Personal Income Model Ranges | |

|---|---|

| Range | Description |

| Missing | Where score is missing or default values |

| <=20 | Where PIM is <= $20,000 |

| 21-30 | Where PIM is above $20,000 and <= $30,000 |

| 31-40 | Where PIM is above $30,000 and <= $40,000 |

| 41-50 | Where PIM is above $40,000 and <= $50,000 |

| 51-60 | Where PIM is above $50,000 and <= $60,000 |

| 60+ | Where PIM is greater than $60,000 |

Personal income data can be used in risk segmentation as well as in prescreening, underwriting, account management, cross-selling and upselling, and collections.

Age of Borrowers

Age is borrower’s age, as reported to Equifax, at the time of origination of loan. Age ranges were created based on population distributions pulled from 100% of Equifax consumer credit files. Some minor adjustments were made to the ranges to ensure enough trades/accounts would fall in each range to reduce the risk of low cell counts.

| Age Ranges | |

|---|---|

| Range | Description |

| N/A | Where age is missing or < 18 |

| <=24 | Where age is >=18 and <=24 |

| 25-34 | Where age is 25 to 34 |

| 35-44 | Where age is 35 to 44 |

| 45-54 | Where age is 45 to 54 |

| 55-64 | Where age is 55 to 64 |

| 65-74 | Where age is 65 to 74 |

| 75+ | Where age is >=75 |

Presence of a Mortgage

Presence of a mortgage flag denotes whether the borrower has a residential loan (Mortgage, HELOC, HELOAN) at time of origination for other loans. The flag takes on the values Yes and No. It allows users to split other product categories into mortgage holders and non-holders. The information represented in this variable has become increasingly valuable since the Great Recession due to the overwhelming impact of the housing crisis on all credit markets.